Summary

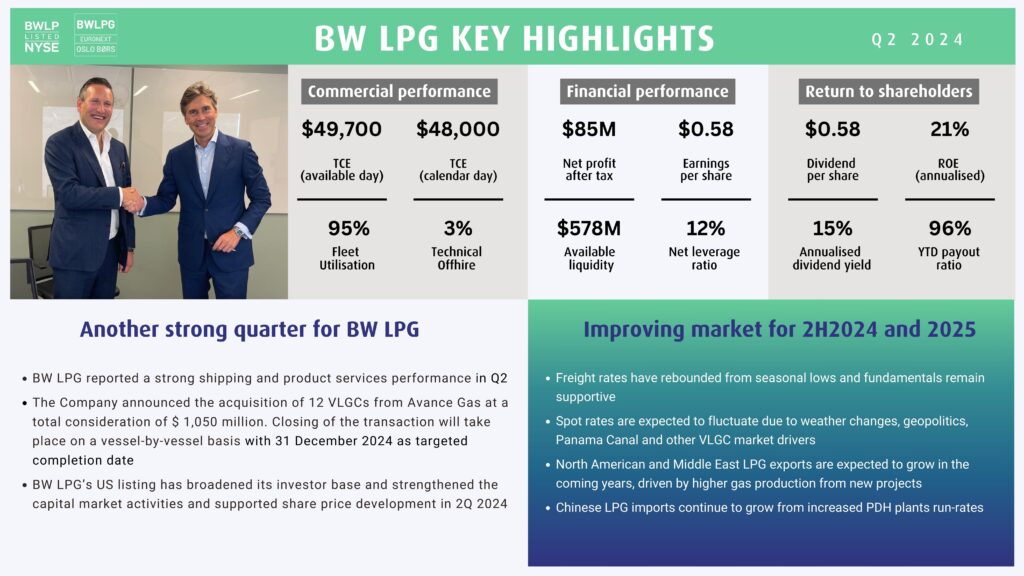

We are pleased to report another good quarter for our fleet, with time-charter equivalent (TCE) in line with our guidance of US$ 49,000 per day. We are also happy to report another profitable quarter for our trading activity in Product Services, with a net accounting profit of just below US$ 16 million. Following our good results, the Board has declared a dividend of US$ 0.58 per share which corresponds to 100% payout of our shipping NPAT of 48 cents, plus $0.10 top up from Product Services.

The biggest news is the subsequent event of last week where we announced the acquisition of the 12 Avance Gas VLGCs for a total transaction price of US$ 1.05 billion. This transaction is a major milestone and shows our capacity to strike large-scale and strategically significant transactions. It also propels BW LPG forward as a leading VLGC shipping and LPG value chain player.

CEO Kristian Sorensen and CFO Samantha Xu discussed our Q2 results during our earnings presentation held on 22 August 2024. A copy of the recording, together with our earnings presentation and Q2 interim financial report are available below.

Q2 2024 Earnings Presentation

Download our earnings presentation here.

Q2 2024 Interim Financial Report

Download our interim financial report for the quarter here.

Q2 2024 Earnings Presentation Recording

Watch a recording of our earnings presentation for the quarter here.

Q2 2024 Earnings Presentation Transcript

Read the transcript of our earnings presentation for the quarter here.

Continued Positive View of the Market

After a slow couple of months over the summer, the US exports have picked up from the delays caused by Hurricane Beryl, and the export volumes from the Enterprise and Targa terminals in the US Gulf are catching up with the back log. The most recent report from Gibson Shipbrokers shows an uptick of 10 VLGC export cargoes from July to August, meaning the number of VLGC loadings in the US, including the east coast, will arrive at 104 for the month of August. The price differential between the US and the Far East is currently around US$ 230 per ton, leaving room for higher freight rates on the back of tighter availability of ships.

Heading into the winter season, the forward market is pricing the Houston/Chiba benchmark leg at around US$ 50,000 /per day, and this is without any Panama Canal delays for VLGCs, indicating an upside on the rates should the canal become more congested. If we look further out on the horizon, there are firm expansion plans from big terminals on the US Gulf coast starting second half next year, and we view these billion-dollar investments as positive for shipping demand when coupled with continued demand growth in the Asian markets.

In the Middle East, the annual export volumes are rather stable with seasonal reduction in export volumes over the summer due to maintenance and higher domestic consumption. There is a lot of focus on the demand growth in China and the Indian sub-continent, while the rise of the Southeast Asian market is overlooked by many observers. This region, with growing population and prosperity, imported around 13 million tons of LPG last year, and is surfacing as a considerable consumer of LPG which also sources significant volumes from the US.