Summary

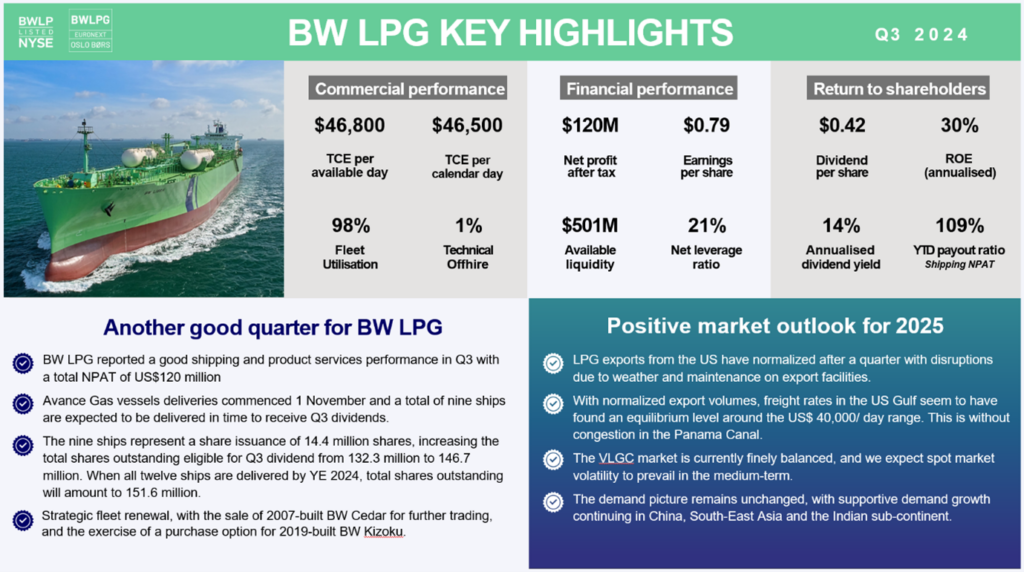

We published our Q3 2024 financial results today. It has been another good quarter for the Company, with TCE income of $46,800 per available day. We are also happy to report a strong quarter for our trading activity in Product Services generating a net profit after tax of US$58 million in Q3. Following our performance for the third quarter, the Board has declared a dividend of US$ 0.42 per share. A copy of the recording, together with our earnings presentation and Q3 interim financial report are available below.

Q3 2024 Earnings Presentation

Download our earnings presentation here.

Q3 2024 Interim Financial Report

Download our interim financial report for the quarter here.

Q3 2024 Earnings Presentation Recording

Watch a recording of our earnings presentation for the quarter here.

Q3 2024 Earnings Presentation Transcript

Read the transcript of our earnings presentation for the quarter here.

Positive Market Outlook for 2025

The third quarter of 2024 began on a challenging note for VLGC owners, as the Panama Canal normalized operations, putting sailing distances and VLGC utilization under pressure. Weather and technical issues also meant fluctuations in export volumes. This translated to volatility in spot rates, swinging as low as US$23,000/day and US$50,000 during the quarter.

In the US, export volumes were negatively affected in July by Hurricane Beryl. Subsequently, exports rebounded in August. Towards the end of September however, one export terminal announced it had to close for unscheduled maintenance due to problems with their chilling capacity. This negatively impacted overall VLGC loadings in both September and October. These issues were eventually resolved, and going into November, all major US Gulf Coast export terminals were running at full capacity.

Despite these challenges, LPG exports carried on VLGCs out of North America grew 6.7% in the third quarter, compared to the same period in 2023, reflecting the strong underlying trend in production and exports.

The new locks in the Panama Canal are operating near full capacity, with the old locks increasing throughput as well. While this reduces fleet wide inefficiencies, LNG carriers and dry bulk vessels are also gradually returning to the canal, increasing the competition for transit slots.

In the Middle East, OPEC+ announced in early November that the voluntary production cut would be extended to the end of December. The voluntary production cut contributed to LPG on exports on VLGCs only growing 0.6% for the third quarter compared to Q3 2023.

Year-to-date, 20 new VLGC vessels have been delivered, and there are plans for the delivery of 2 more throughout the remaining months of 2024, and 13 VLGCs for delivery in 2025. Established shipbuilders are indicating deliveries no earlier than 2027 for new VLGC orders.

Following a quarter with disruptions in exports and volatility in rates, it is encouraging to note that LPG export terminals are again back to high levels of exports. Going forward, several terminal expansion projects in the US, are expected to support growth for North American LPG export growth in the high single-digits for the next three years.

Middle East LPG exports are expected to grow in the mid-single digits over the coming years, driven by higher gas production from new projects in Qatar, UAE and other countries in the region.

Furthermore, Chinese PDH plants are currently operating at above average run-rates, with 5 and 6 new PDH plants scheduled to start up in 2025 and 2026 respectively, supporting growth in LPG imports.

The Houston-Chiba FFA market for CAL2025 is currently trading at ~US$ 40,000 per day, although with limited liquidity.

The spot market is expected to fluctuate however, driven by weather changes, geopolitical situation, Panama Canal availability and other drivers of the VLGC market.